Why Supply Chain Analytics Is Replacing Traditional Compliance

In today’s complex global economy, supply chains generate vast amounts of data. This spans supplier transactions and compliance records to real-time shipment tracking and performance metrics. Effectively harnessing this data through supply chain analytics transforms traditional operations, enabling organizations to move from basic compliance tracking to proactive, intelligence-driven strategies.

This evolution enhances supply chain visibility, allowing businesses to anticipate disruptions, optimize processes, and maintain a competitive edge. By integrating predictive risk assessments and supplier performance monitoring, companies can address potential issues before they escalate, ensuring smoother operations and improved resilience.

The significance of this shift is underscored by the rapid growth of the supply chain analytics market. Valued at USD 6.12 billion in 2022, it is projected to expand at a compound annual growth rate (CAGR) of 17.8% from 2023 to 2030, reaching USD 22.46 billion by 2030.

As organizations navigate an increasingly volatile landscape, leveraging real-time supply chain risk insights becomes essential. This approach not only ensures supplier compliance but also drives strategic decision-making, positioning businesses to thrive amid uncertainty.

The Limitations of Traditional Supplier Compliance Frameworks

For years, supplier compliance has been the foundation of responsible procurement. Standardised pre-qualification frameworks, such as PAS 91 and the Common Assessment Standard (CAS) used widely across the UK construction industry, were developed to bring consistency and reduce duplication across supply chain onboarding.

These frameworks serve an important role. They verify that suppliers meet core requirements in areas such as health and safety, financial stability, and insurances. But for many organisations, meeting the standard has become the end goal rather than the starting point.

What is often overlooked is the value of the data that sits behind those certifications.

Pre-qualification exercises and supplier onboarding generate rich datasets from policies, processes, performance history, and audit outcomes. In most cases, this data is used once to produce a compliance outcome, then left static in a portal until the next renewal cycle.

But what if that data could do more?

With analytics and predictive risk models, organisations can turn supplier data into actionable insight:

- Identify behavioural patterns that indicate rising or falling performance

- Surface emerging compliance risk before it impacts delivery

- Compare contractors across projects, geographies, or business units

- Track real-time status changes such as lapsed documentation or adverse media

While many solutions focus on helping suppliers gain CAS certification, few provide tools to actively use the data captured during that process. The result is that organisations miss out on critical opportunities to improve supplier visibility, optimise decision-making, and reduce operational risk.

In high-risk sectors such as construction, where subcontractor chains are deep and project timelines are tight, knowing which suppliers are certified is no longer enough. Organisations also need to understand which ones are vulnerable, declining in performance, or introducing hidden risk into the value chain.

The Rise of Predictive Risk Management

Collecting supplier compliance data is a starting point, but the real value lies in what organisations can do with it.

As global supply chains become more complex and expectations increase around ESG, financial resilience, and contractor safety, businesses need a more agile way to respond to risk. That is where predictive risk modelling and supply chain analytics come in.

Predictive risk management uses historical and real-time data to identify early signals of potential disruption. These could include a supplier missing critical deadlines, a pattern of lapsed certifications, or warning signs around financial stability. Rather than reacting to issues after they occur, organisations can intervene earlier and prevent disruption.

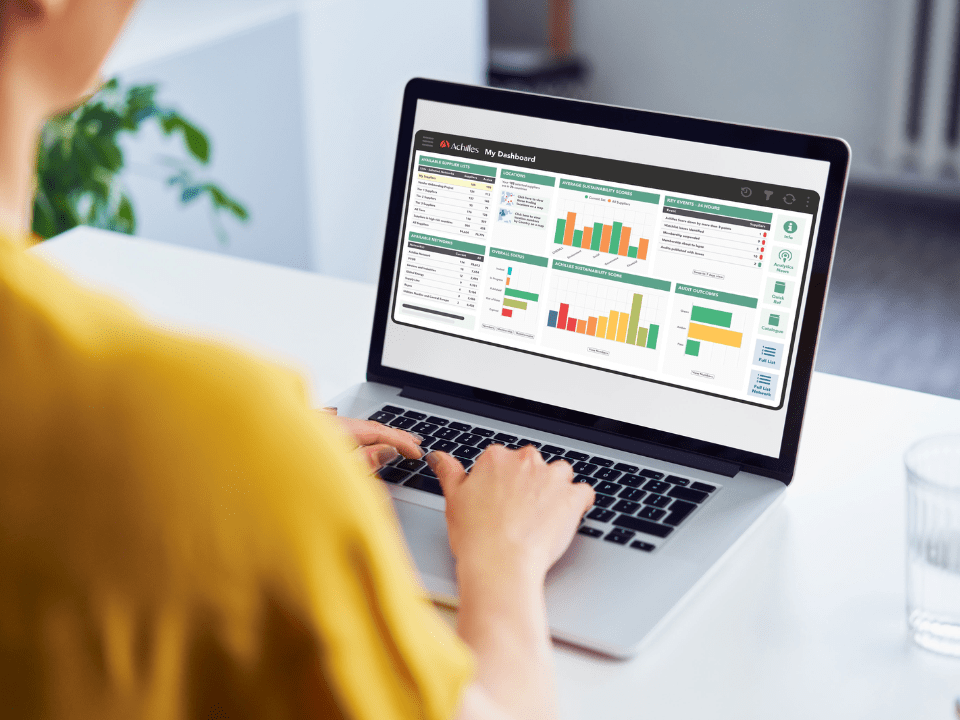

The Achilles Analytics Platform supports this shift by combining structured compliance data with:

- Predictive scoring models that highlight suppliers likely to fall out of compliance

- Risk clustering that detects behavioural patterns across projects, roles, or geographies

- Visual dashboards that track trends in health and safety, ESG, and audit outcomes

- Configurable alerts based on the risk indicators that matter most to each organisation

These tools help procurement, compliance, and HSEQ teams focus their attention where it is needed most enabling smarter decisions that protect delivery, safeguard people, and uphold governance standards.

What Visibility Looks Like

Many organisations have systems in place to manage their Tier 1 suppliers, but risks often reside deeper in the supply chain. Subcontractors, indirect suppliers, and service providers at Tier 2 can introduce significant vulnerabilities, especially when they operate without the same level of oversight.

According to Boston Consulting Group (BCG), the risk of disruption increases significantly at sub-tier supplier levels. Tier two suppliers face 21% higher disruption risk than tier one, and tier three 38% higher than tier one. .Yet many businesses still rely on static lists and manual outreach to understand who their sub-suppliers are and what risks they carry.

Without full visibility, it is difficult to identify:

- Which contractors are introducing reputational or compliance risk.

- Where ESG misalignment exists across the value chain.

- How financial instability or delivery delays are emerging at lower tiers.

Supply chain analytics enables organisations to move beyond assumptions. Platforms like Achilles help build multi-tier visibility by consolidating data from thousands of suppliers into one connected view. This allows users to:

- Discover relationships between primary contractors and their subcontractors.

- Monitor risk across entire projects, not just named vendors.

- Generate heat maps and segmentation views based on risk profile, category, or geography.

This level of insight not only supports better decision-making, but also prepares organisations for upcoming regulatory requirements. This includes expectations under frameworks such as CSRD, the Procurement Act, and sector-specific pre-qualification models.

True visibility is not just knowing who your Tier 1 suppliers are. It is understanding where risk exists across the entire network and having the tools to act on it.

From Compliance to Competitive Advantage

Compliance will always be essential, but in today’s environment it is no longer enough. To manage risk effectively and operate with resilience, organisations need to go further by using the data they already collect to inform smarter decisions, prioritise action, and drive improvement.

Supply chain analytics, predictive risk modelling, and supplier performance monitoring give businesses the tools to move from static compliance checks to continuous, data-led decision-making. This shift enables organisations to identify vulnerabilities early, intervene before disruption occurs, improve supplier engagement through greater transparency, and allocate resources more effectively based on real-world risk. It also helps build trust with stakeholders by demonstrating active governance and accountability.

These are not simply risk mitigation tactics but strategic enablers of operational efficiency, reputational resilience, and long-term value. As regulatory demands grow and supply chain pressures intensify, the ability to turn compliance into intelligence will define the organisations that lead.