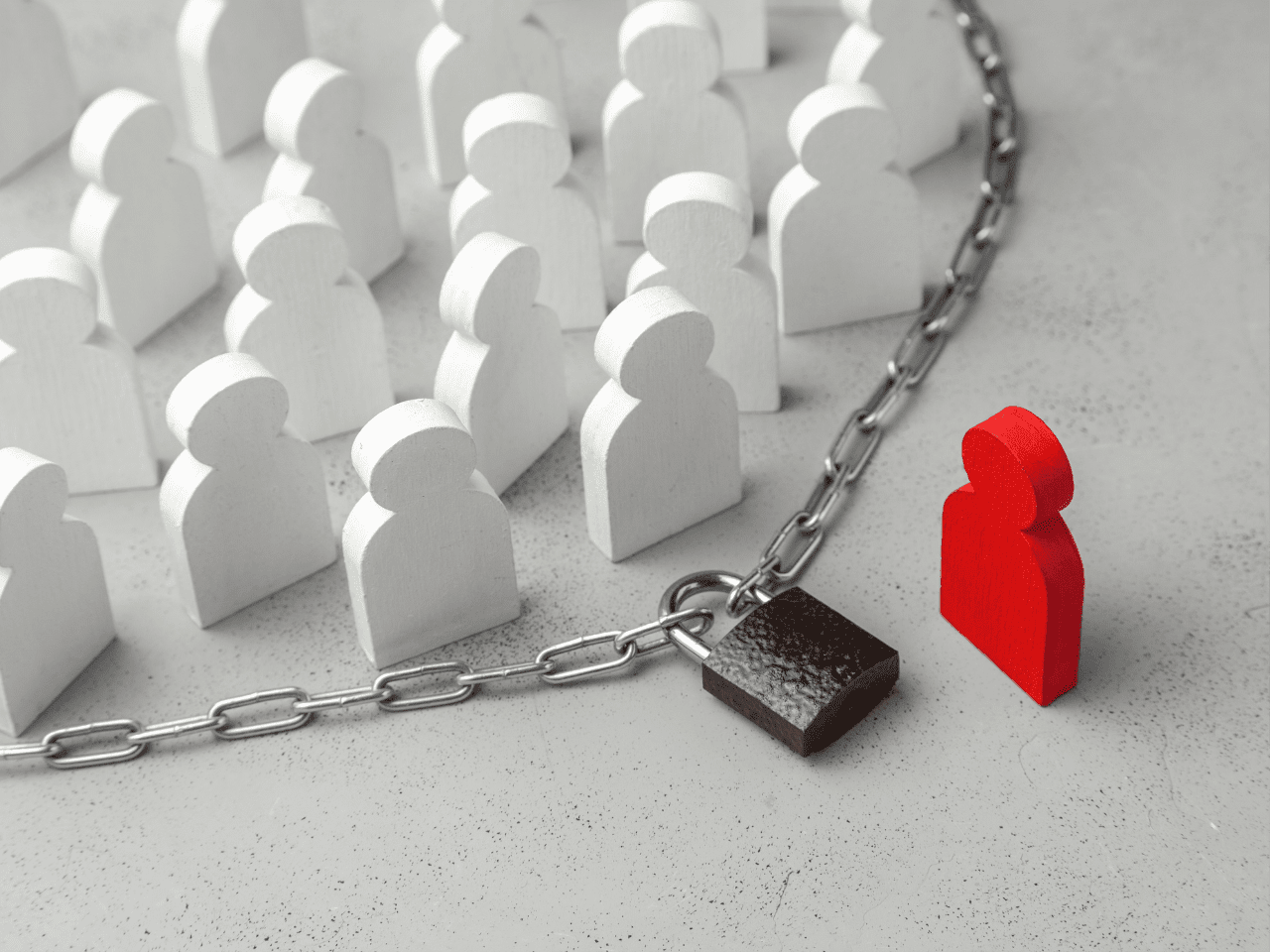

Supplier diversification is a business strategy and describes the abundance and flexibility of the suppliers for a certain product. Supply chain resilience is increasingly important as businesses look to mitigate the impact of geopolitical instability, economic volatility, climate events, and ongoing disruption to global trade.

The success of diversifying your supply chain, more specifically looking into offshoring and nearshoring, depends on how prepared you are to thoroughly and realistically identify the potential risks in your supply chain. Companies must focus attention on understanding vulnerabilities and sources of potential risk, and how to react swiftly and effectively as conditions change.

According to a McKinsey report, 16% to 26% of exports, worth between $2.9 trillion and $4.6 trillion, could be in play, whether that involves reverting to domestic production, nearshoring, or new rounds of offshoring to alternative locations.

Nearshoring and offshoring in a risk context

Diversifying suppliers can unlock innovation and it can also help create more agile and ethical supply chains. Nearshoring can also have significant impact, particularly in Europe, when it comes to driving standards around both carbon footprint and a CSR perspective.

The current context is that many companies, particularly those in the retail, electronics, pharma and automotive sectors, remain heavily dependent on China and parts of Asia. There are more than 50,000 companies with Tier 1 suppliers in China, and a significant proportion of active pharmaceutical ingredients continue to be produced across China and India. Recent years have further exposed how concentrated sourcing, combined with trade tensions, sanctions, logistics bottlenecks, cyber risk, and regional conflict, can amplify disruption across global supply chains.

Supplier diversification also provides a real potential opportunity for companies in energy intensive and asset heavy sectors reassessing long term risk and transition plans. As markets shift away from fossil fuels, organisations in the Oil and Gas sector are increasingly looking to offshore and diversify activities into renewable energies, such as offshore wind. A recent Achilles webinar discussed this transition in the UK more fully – listen again here.

Stay ahead of the game

Now more than ever, it is crucial to have a complete view of the supplier base, coupled with the ability to identify, assess, and access alternative and pre qualified suppliers in real time. To find out how Achilles can support your sourcing strategies, get in touch.