Climate change mitigation efforts are a global priority and governments worldwide are implementing measures to reduce greenhouse gas (GHG) emissions. Carbon taxes, like the European Union’s Carbon Border Adjustment Mechanism (CBAM), are becoming increasingly important in this fight. CBAM will have a significant impact on the Indian Energy-Intensive and Trade-Exposed (EITE) sectors, and companies need to be prepared.

Understanding CBAM

CBAM is the world’s first carbon border tariff on carbon-intensive products, introduced by the European Union (EU) to reduce ‘carbon leakage’ associated with importing certain goods from third countries into the European market. This price mirrors the carbon price of domestically manufactured products, as determined by the EU’s Emission Trading System (ETS). CBAM will initially cover imports in six sectors: aluminum, cement, electricity, fertilizers, iron and steel, and hydrogen.

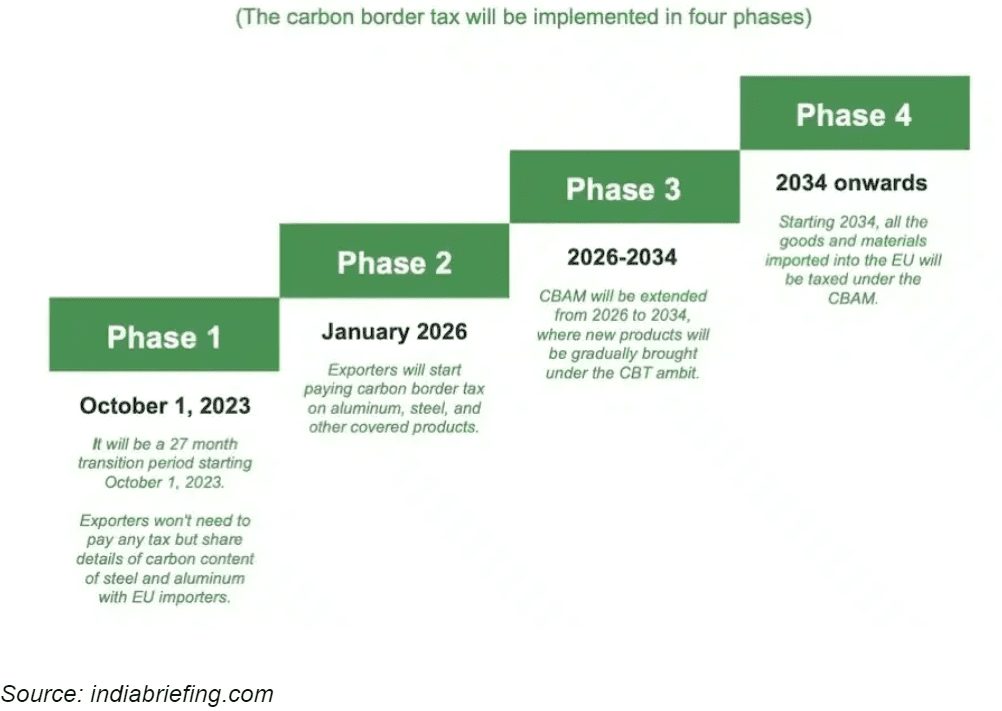

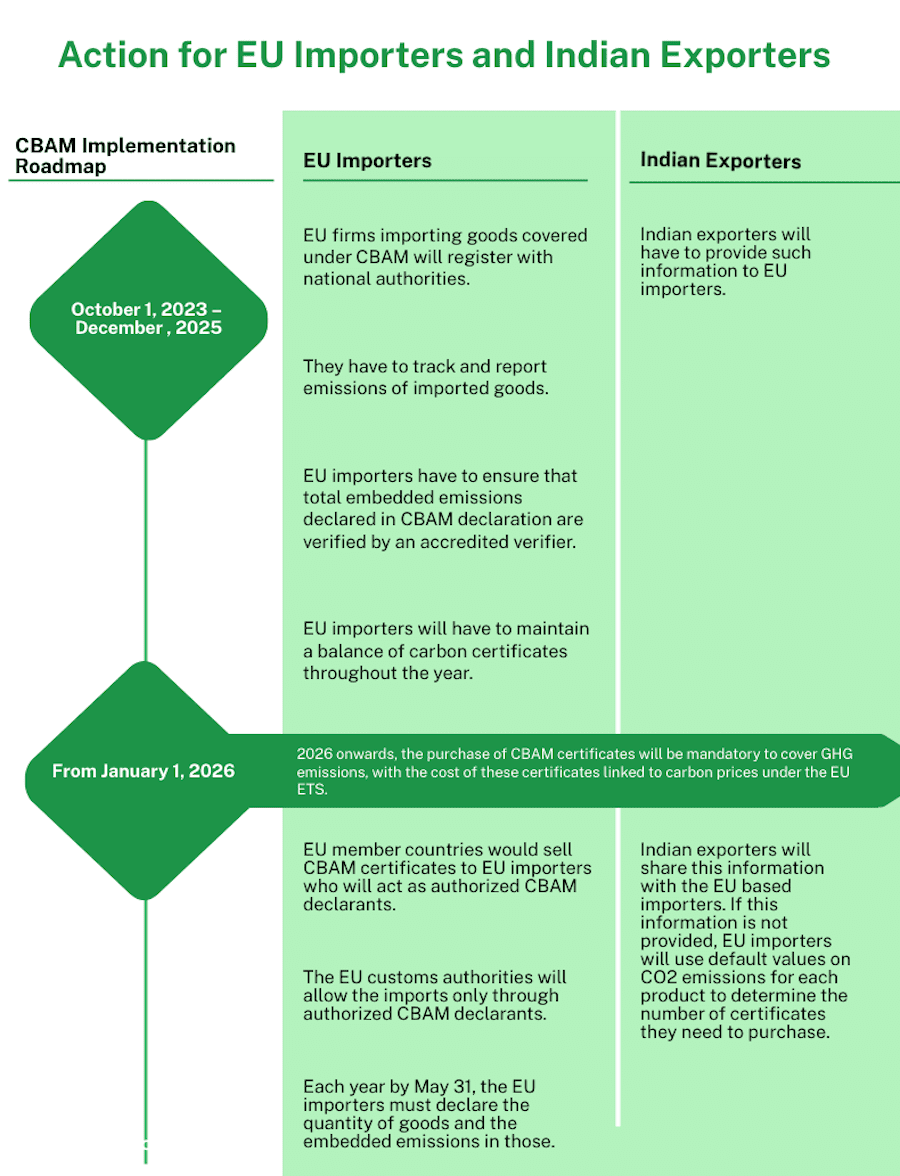

- Reporting Phase: From October 2023, importers must begin reporting embedded carbon emissions in their consignments.

- Taxation Phase: Starting January 2026, importers must purchase CBAM certificates to cover the emissions.

The potential cost increases could force businesses to shift their production focus toward sustainability and greener supply chains.

Implications for Indian EITE Sectors

India’s EITE sectors such as, cement, steel, aluminium and fertilizers stand to be significantly affected by CBAM. India’s reliance on thermal power and relatively high carbon intensity in production processes could lead to increased costs, reduced competitiveness, and lower demand within the EU.

The EU’s recently released default values for carbon emissions during the transitional period could serve as a potential benchmark for calculating carbon tax. Most of these EITE Indian industries are reporting on default values. However, Indian industries are concerned that the EU may release country-specific default emission numbers for India that are higher.

Challenges and Uncertainties

- Taxation: The exact tax levy under CBAM remains uncertain, with the potential for a substantial impact on Indian EITE sectors.

- Carbon Intensity: India’s carbon tax rate is currently among the lowest in the world, at just USD$1.6 per tonne of CO2 emissions. However, India’s reliance on thermal power over renewable sources in these EITE industries contributes to higher carbon intensity, which could increase costs and reduce market access.

- Default Values: Initially, relying on default values for emissions calculations may underestimate the actual carbon footprint, leading to higher costs later.

How Achilles Helps with CBAM Compliance

For Indian businesses exporting to the EU, Achilles offers two options – the Achilles network with the Achilles Carbon Management Module enables you to capture your carbon emissions data and easily share it with your customers to meet CBAM reporting requirements. You can also choose to go further with Achilles Carbon Reduce which provides ISO14064-1 Certification, achieves an average of 50% carbon reduction in within 5 years and an SBTI approach that enables you to meet any reporting requirements with confidence.

The Achilles Carbon Management Module also provides a cost-effective and efficient way for companies to capture carbon data from across the supply chain to meet Scope 3 reporting requirements. Achilles works with your suppliers to support them through the data capture process and give you the best data results – laying the foundation for accurate CBAM reporting.

The CBAM transition period (2023-2026) presents an opportunity for Indian companies to re-evaluate supply chains, prioritize sustainability, and explore greener production methods. Don’t wait for CBAM’s full implementation to act. Partner with Achilles now to streamline your CBAM compliance efforts and build a more sustainable future for your business.