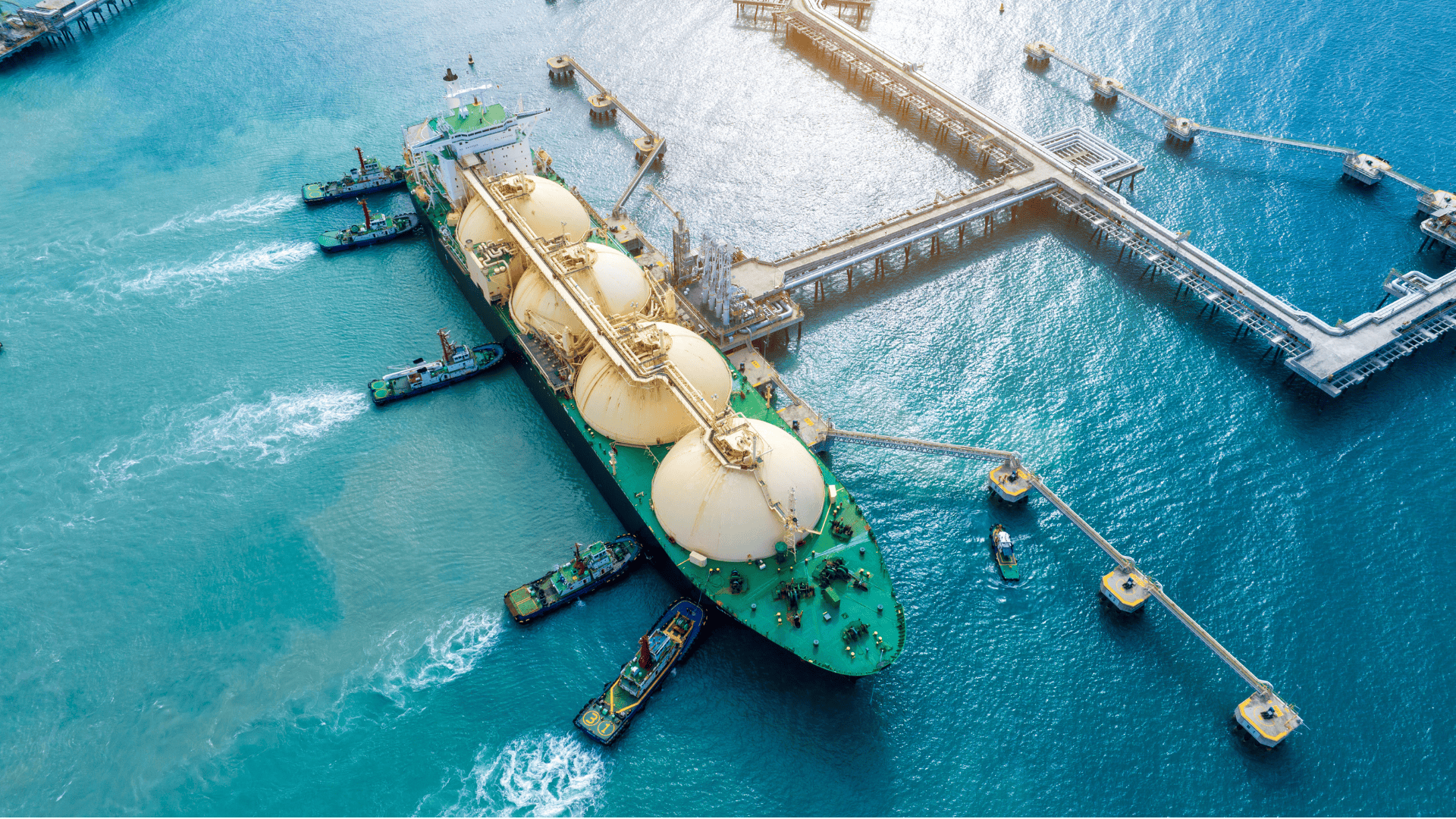

How an industry collaboration programme to increase supplier due diligence led to a deeper focus on ESG for leading VLGC owner BW LPG

Asia is the world’s biggest shipping market, controlling the highest share of vessel tonnage, as well as the majority of cargo and shipbuilding capacity. With this leading position comes a responsibility for corporate behaviour that reflects high quality across the value chain.

For companies operating in Asia, the need for transparency, compliance and reporting is growing in importance, not least for subsidiaries of European operators.

Among the leaders with operations in Asia is BW LPG, listed in Oslo and New York, with a large presence in Singapore, where Rick Ackermann, Head of Procurement, is located. Among his tasks on arriving at the company was to improve transparency and standardise data on the company’s suppliers.

“I was aware of Achilles because of my time in the offshore industry, but it wasn’t until I joined BW LPG five years ago that I realised how much the platform had been improved from when I first saw it,” he explains.

He was initially able to access information on suppliers that it shared with the BW Offshore business unit. Then, in 2023, Achilles launched an initiative to bring together a group of Procurement Managers to discuss coordinated vetting and onboarding of suppliers for shipping companies.

“The idea of having a standard so that suppliers don’t have to repeat the prequalification vetting process was an interesting one and it became even more interesting when Achilles added ESG components to the platform,” he says.

BW LPG already had a supplier assessment programme, though its design required manual data updates. Using Achilles, the supplier gets a notification when they need to renew certificates so this part of the processes is automated and outsourced for the owner.

“We have our own supplier code of conduct and business ethics, which is fully integrated into all our agreements, but we needed a platform that we could use to ask suppliers about governance policies, financial reports, scope 1, 2 and 3 and create a single source of truth, for all five business elements that are relevant” says Rick.

Vetting proved to be the process that opened the door to questions around ESG that would help BW LPG understand more about its suppliers’ performance.

As a global player, BW LPG is keenly aware of the impact of national and international regulations on reporting and transparency. Initially, Rick found himself on an education mission in the Asian supply chain he hadn’t expected.

Environment, Sustainability and Governance was originally considered an investment principle that prioritises environmental and social issues and corporate governance. These days, ESG is considered a sustainability tool that reflects the company’s business model, how its products and services contribute to sustainable development and how it manages its operations to minimise negative impact.

“Four or five years ago, you had to explain to some companies what ESG was and share sustainability reports so they could understand what we wanted. Companies just weren’t aware, but once they recognised the need, they caught up really fast.”

BW LPG hired a dedicated ESG officer three years ago and is just about to publish its fourth sustainability report. Making that investment reflects BW LPG’s intent of being a front runner, but Rick recognises the snags too.

Starting the process, Rick found some pushback from bigger suppliers who felt they were already doing enough on ESG, while some smaller suppliers felt the costs might not be reflected in their commercial offer.

“The truth is we can pretend to have an option on ESG, but we don’t; we must do it. There is no one standard or certificate, but an opportunity to set yourself apart from competitors,” he says.

For BW LPG, the benefits have already accrued in terms of reputational payback. A routine audit of the company by a class society gave kudos for the company’s retention of Achilles. The final report noted the advantages this could create and in a comment the auditor said he had never seen something similar before in this context.

“This was outside the scope of the audit, but for which we received a maximum score of five, so our total score also increased. Next year, it will be in the scope, so we need to continue to make improvements.”

For the future, Rick is optimistic that Achilles can continue to support BW LPG’s business and advocates for the shared benefits of the platform. “The more suppliers are on the platform, the better for them because they are in the shop window. I don’t have to sell the benefits to suppliers, and I can spend more time on monitoring the process. Our suppliers can also share with their other clients that they had gone through the process,” he says.

And in an industry where well-intentioned initiatives can take years to crystalise results, he thinks Achilles has hit the right place and time, something that is reflected in BW LPG’s business practices. “Five years ago, ESG was the fourteenth-ranked criteria in the tender evaluation process. When we evaluated a tender again this year, we moved it up to the fourth place and given it a much higher weighting,” he concludes. “It may never be number one, but it is a significant step. Like an ISO9001 certificate, it will be pre-conditional to a bid at one point in time, not a criterion. In a few years’ time, if you don’t have a way to certify your ESG performance, you won’t be part of the tender.”