The drive to net zero presents a huge opportunity for the global energy sector. Alongside the focus on renewable energy, there is also a very welcome increasing focus on people too – looking beyond emissions reductions, to wider environmental pollution, human rights, modern slavery, child labour and health and safety. What does that mean for energy companies as they look to the future?

There is no doubt that we are living in an interesting time for the energy industry. The world is shifting from a dependence on fossil fuels to a world where 90% of electricity generation is predicted to come from renewable sources. The UN has set out its sustainable development goals and across the business world, organisations are responding by embracing a new Environmental Social Governance (ESG) era that encompasses GHG emissions and the drive to net zero.

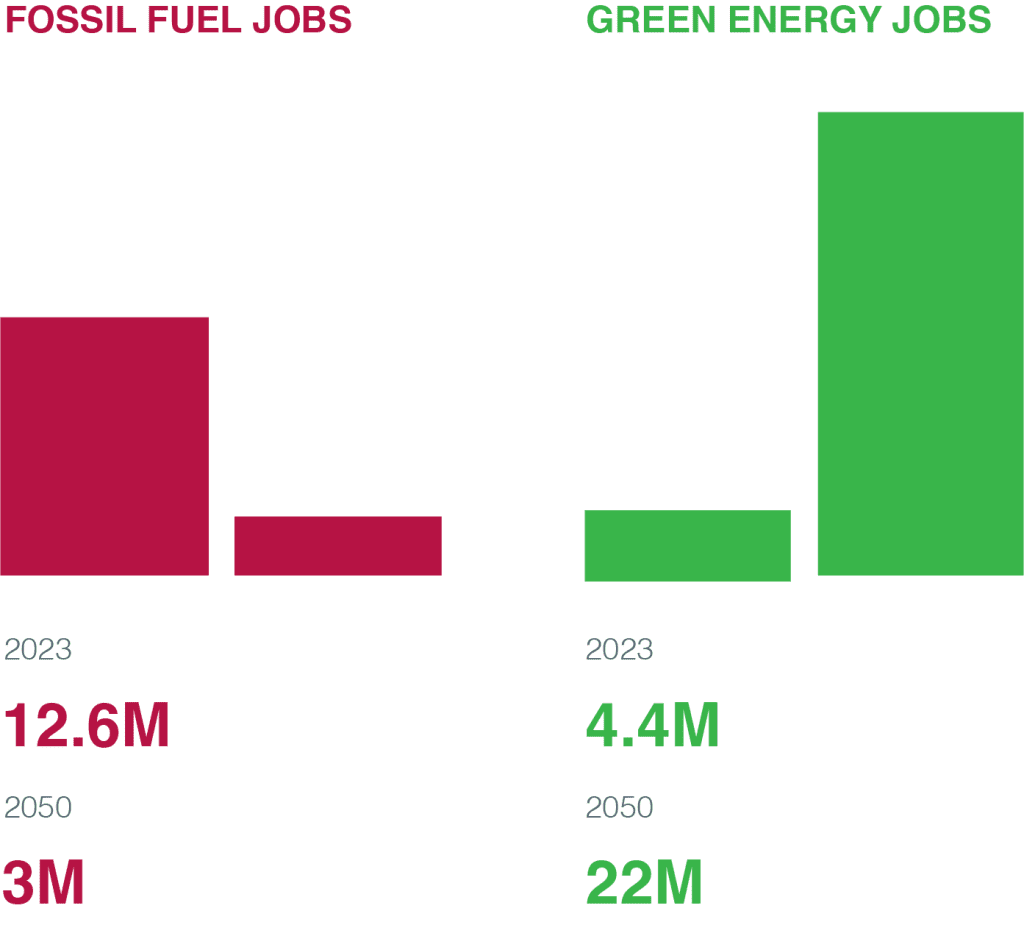

With that comes massive change in the global energy landscape. As we work towards the 2050 net zero target, jobs in the fossil fuel sector are set to fall from current levels of 12.6 million to around 3 million and global green energy jobs are predicted to grow fivefold from 4.4 million today to 22 million with most gains are predicted to be in the wind and solar sectors.

To support that shift, there is going to have to be massive infrastructure investment. Annual investment in transmission and distribution grids is expected to expand from USD 260 billion to 820 billion by 2030. Public charging points for Electric Vehicles are expected to rise from 1 million today to 40 million in 2030 (that is the equivalent of adding almost 20 gigafactories each year for the next ten years). Pipelines and hydrogen enabling infrastructure is expected to increase from USD1 billion today to around 40 billion in 2030.

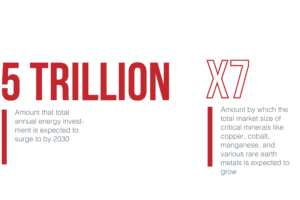

Overall, total annual energy investment is expected to surge to USD 5 trillion by 2030 adding an extra 0.4 percentage points a year to the annual global GDP growth. The total market size of critical minerals like copper, cobalt, manganese, and various rare earth metals will likely grow almost sevenfold. The size of the opportunity for the global energy sector is almost mind boggling.

Alongside this focus on renewable energy, there is also a very welcome increasing focus on people too. What is being referred to as the “Just Transition” addresses the wider UN Sustainability Goals, that look beyond emissions reductions, such as environmental pollution, human rights, modern slavery, child labour and health and safety.

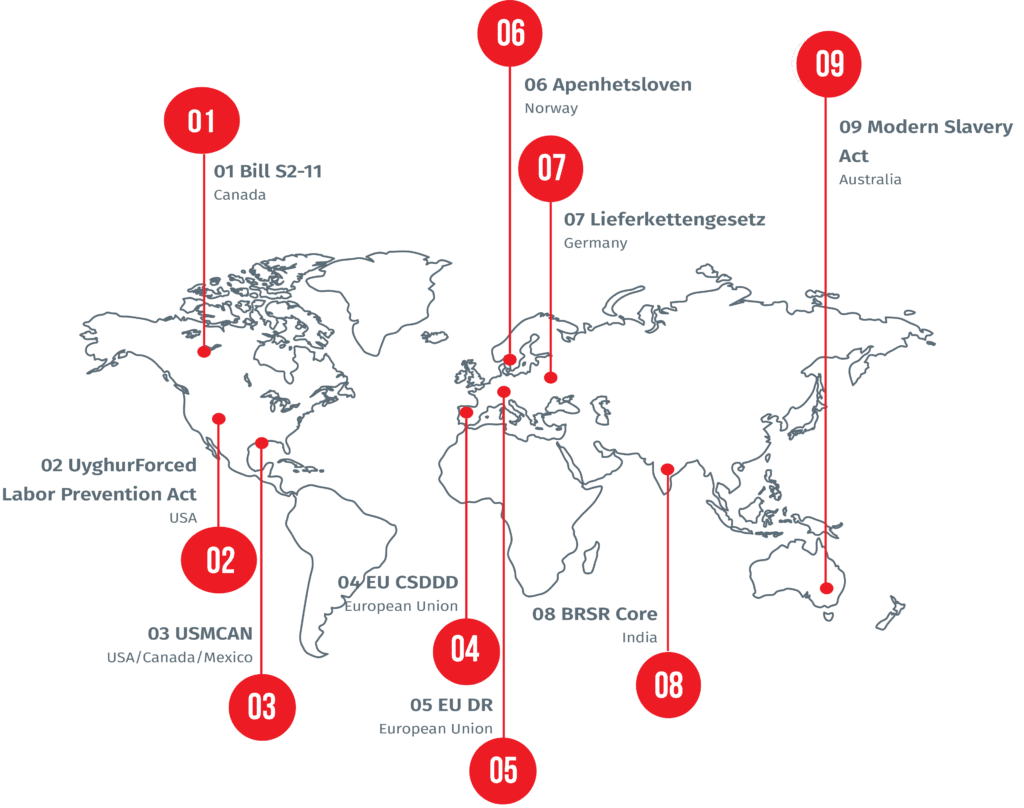

To support those goals, organisations are increasingly finding themselves being swept up in a metaphorical ESG regulatory net – whether that be Canada’s Bill S-211, Germany’s Lieferkettengesetz, Norway’s Apenhetsoven, India’s BRSR Core or the EU’s impending Corporate Sustainability Due Diligence Directive.

Increasingly, this regulatory net is being designed to require companies, wherever they operate, to assess the potential for human rights and environmental risks within their supply chains and report on what they are proactively doing to address them. So even if you are located in a country or geographic region that doesn’t yet have regulation in place, it is still likely to have an impact on your business in the short to medium term.

For example: The Lieferkettengesetz in Germany also applies to companies that import goods into Germany, regardless of where the company is based, if the imported goods are intended for sale or use in Germany and, since December 2021. The USA’s The Uyghur Forced Labor Prevention Act has worked to prevent goods potentially made with forced labor in the Xinjiang region from entering the US market. The EU Deforestation Regulations relate to derived products hence impact things like sales of wind turbine blades, welding aprons/gloves and even car interiors.

And it’s not only a regulatory issue… Increasingly, environmental law firms are launching litigations aimed at bringing companies to account for overstating green credentials or not having sufficiently robust plans in place to deliver green targets and, in more and more of the world, ethical business and business as a force for good is now becoming the focus of the investment community – who are being regulated themselves to take ESG seriously.

Financial institutions are captured under the UN Guiding Principles on Business and Human Rights where they are required to have corporate responsibility to respect including the requirement to avoid causing or contributing to adverse human rights impacts and seek to prevent or mitigate adverse human rights impacts that are directly linked to their operations, products or services by their business relationships.

TCFD in the UK now requires financial institutions to make non-financial disclosures relating to things like Carbon emissions. The Modern Slavery Act in Australia is requiring investment companies to report on the risks of Modern Slavery in their financial investments. In Thailand, publicly listed companies must report annual on sustainability issues including human rights. The list goes on.

There are also very tangible benefits emerging for companies that can demonstrate their sustainability credentials. Lenders are increasingly reducing interest rates for the period of the loan or offering more favourable loan terms. Meeting agreed KPIs are significantly reducing borrowing over the lifetime of the finance. The cumulative issuance of green or sustainability bonds has now reached $3 trillion worldwide and companies with higher ESG scores on average enjoy a 10% lower cost of capital.

With so much investment needed in infrastructure to realise the scale of the green energy opportunity that is a number that cannot be ignored. If the social and environmental argument was not enough – it’s not “just’ about people and planet… it’s now about profit too.

It’s becoming very clear that complying with ESG regulation can bring significant benefits to organizations, including improved reputation, reduced risk, increased efficiency, competitive advantage, and long-term sustainability.

- Complying with the law can help improve an organization’s reputation as a responsible and ethical business. By taking steps to prevent human rights abuses and environmental damage in their supply chains, organizations can enhance their brand image and increase customer loyalty.

- It can help reduce the risk of legal action, fines, and reputational damage. By identifying and addressing potential risks in your supply chains, you can minimize the likelihood of human rights abuses or environmental damage occurring and mitigate any negative impacts.

- By implementing due diligence measures and monitoring suppliers, organizations can identify areas for improvement, optimize their supply chain operations and drive efficiencies.

- Demonstrating a commitment to responsible business practices can help organizations attract and retain customers, investors, and employees who prioritize sustainability and ethical business practices.

- It can also contribute to the long-term sustainability of an organization’s operations. By taking steps to prevent environmental damage and ensure the health and safety of workers, organizations can reduce their environmental footprint and promote the well-being of their employees and the communities in which they operate.

However, what we find is that there is, all too often, a big gap between what companies want to do, what they say they will do… and their ability to do it. For many years, policies, or statements of commitment have been relied upon as tools to combat the issue of human exploitation, but the data clearly shows more needs to be done. There have been many examples of organisations over the last decade or so that have been found not to have done enough [read our helpful blog on this topic “What is enough?”]. That experience is supported by the International Labour Organisation which estimates that on any given day in 2021, 49.6 million people were living in modern slavery, which is an increase of 10 million people since 2016.

In our work to support companies to achieve ESG supply chain ambitions and meet increasingly demanding regulatory and investment, Achilles collects and assesses supply chain data from a wide range of sources including knowledge and insight collected from many years of on-site audits and worker interviews to provide a comprehensive picture of supply chain risk. Our findings correlate with the ILO and UN analysis, that human rights abuses and environmental pollution are far too commonplace, but often deeply hidden in the complexity of modern supply chain structures and in a way that cannot easily be found by simply asking suppliers some questions or scraping data from the internet.

The truth is that it is relatively easy to agree that we want a global supply chain that doesn’t include child labour or modern slavery or negative impacts to our environment, but less easy to ensure that it happens. Today’s supply chains are complex and getting increasingly so and that makes it hard for organisations to manage.

Companies need to be looking at multiple data sources in different languages and different formats – often of questionable provenance. Most organisations don’t have the systems to record the data, track relationships or identify correlations. There are insufficient resources to undertake credible data checking or independent verification and, this isn’t a one and done type of thing so the ongoing intensive burden on organisations is hard to sustain.

All that leads to inadequate assessment of the ESG risks across an organisation’s supply chain, less than adequate ESG risk mitigation and an inability to achieve tangible ESG improvements. For organisations that are subject to the increasing amounts of ESG regulation that also means low levels of reporting confidence. It can also mean losing access to lower cost investment and a high risk of reputation and financial impact.

If you would like to start taking advantage of a data-led, risk-based approach to drive sustainability across your supply chain contact us or click here to arrange a free no obligation ESG consultation and take a step towards creating a safer, fairer and sustainable global economy.